Continental's influence on the DAX 40

Continental has a weighting of 0.49% in the DAX 40 index (Measured in June 2025). View the composition of the DAX 40 and the weighting of all companies in the DAX 40 here. The company's share price is influenced by trends in the global auto industry, such as demand for electric vehicles, changes in commodity prices, and geopolitical developments. In addition, technological advances in autonomous driving and connectivity are playing an increasing role. Investors are closely monitoring margin development, the profitability of the Automotive division, and the pace of innovation. Fluctuations in global demand for new cars and economic growth rates also affect the share's valuation.

Investment analysis & outlook

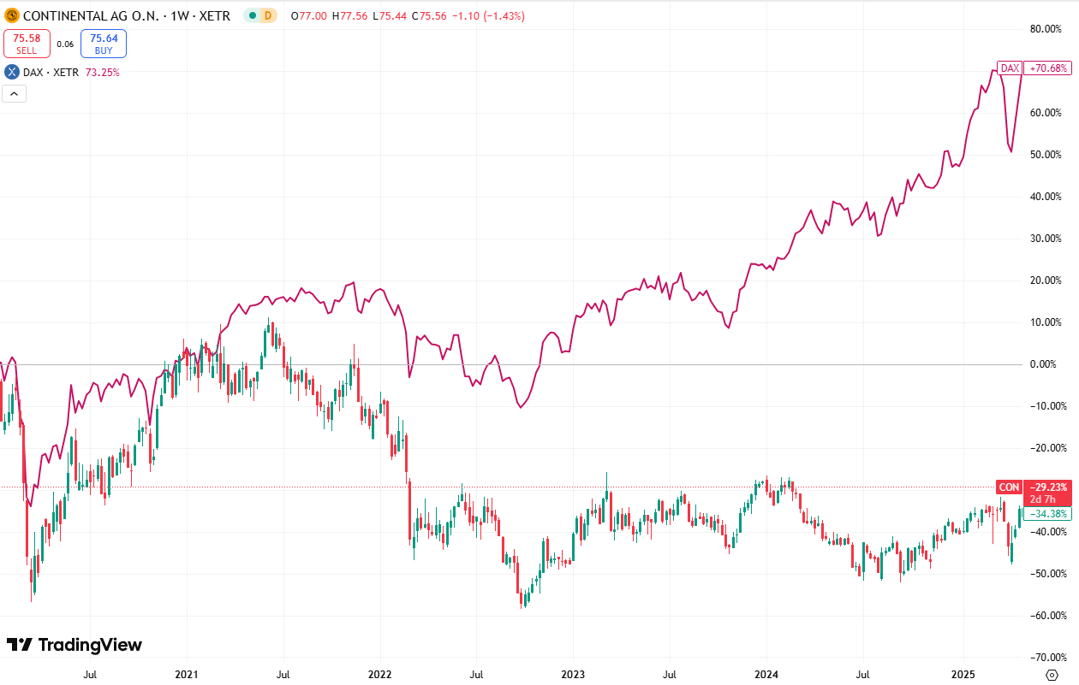

The chart shows a sharp contrast between Continental AG's performance and the broader German stock market index DAX. Whereas the DAX has shown an impressive increase of + 70.68% since 2020, Continental's shares recorded a loss of - 29.23% at the same time. This places the share among the weaker performers within the DAX 40.

Although Continental showed signs of recovery in 2023 and early 2024, the share lagged structurally behind the broader market. The share price is still trading well below the peak levels of 2021, while the DAX managed to reach new record highs. This relative weakness reflects market doubts about profitability, margin pressure, and the speed at which Continental can take advantage of the electrification and digitization of the auto industry.

Looking ahead to 2025, Continental is targeting further growth in the intelligent mobility solutions segment. In doing so, the company expects electrification and software-driven innovation to become key drivers of sales growth. However, margins remain under pressure due to rising labor costs and geopolitical uncertainties, especially in supply chains. Continental AG is not yet showing a convincing technical trend reversal, but the fundamental basis for recovery is in place.

News & updates

In April 2025, Continental announced a strategic partnership with a major Asian tech player to jointly work on control software for autonomous vehicles. In addition, the company announced that it is expanding its tire production capacity in Eastern Europe to better meet the growing demand for summer and all-season tires. Continental also increased its R&D budget for 2025 by €500 million, focusing on software development and sustainable materials.

Management also confirmed a dividend proposal of €2.20 per share, signaling the company's confidence toward shareholders. Continental remains committed to its ambition not only to be a technological leader, but also to play a leading role in sustainability within the mobility sector.

Disclaimer: Investing involves risks. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)

.webp)