Publication date: Sept. 20, 2024

We can observe that it has been rumbling in the top of the German auto industry for some time.

In the period from April to mid-September of this year, Volkswagen's share price fell more than 30%, and in the same period BMW's share price fell over 40%.

In this article, we examine Volkswagen's situation and, above all, assess the opportunities for investors. In the next article we will look at the opportunities for BMW.

.webp)

What's going on with the Volkswagen?

We start with the fact that Volkswagen is Germany's largest auto group. Our eastern neighbors have the largest industry in the EU and also the EU is the largest market in the world with over 500 million people across the 28 countries. Globally, Volkswagen is the second best-selling car brand after Toyota. Noting that last year car sales increased by 2.8% worldwide. This makes Volkswagen a top global player in the auto industry.

Top players also suffer setbacks from time to time. Volkswagen is currently facing some challenges. One of the biggest problems is a delay in the development of their new electric vehicle platform, called Scalable Systems Platform (SSP). This platform, which is important for the next generation of electric vehicles, is being delayed due to software problems. As a result, planned launches of new models have been postponed, and the first vehicles on this platform are not expected to hit the market until after 2026.

In addition, Volkswagen is under pressure due to slower growth in electric vehicle (EV) sales. Although demand for their current electric models, such as the ID.4, is stable, the decline in global EV sales has hit them. However, Volkswagen is focusing on improving existing models and developing new technologies to reverse this trend.

On the financial front, the first quarter of 2024 was slightly weaker than expected, with lower sales and a drop in net profit. Nevertheless, the company remains optimistic about the rest of the year, due to a strong order book and new model introductions.

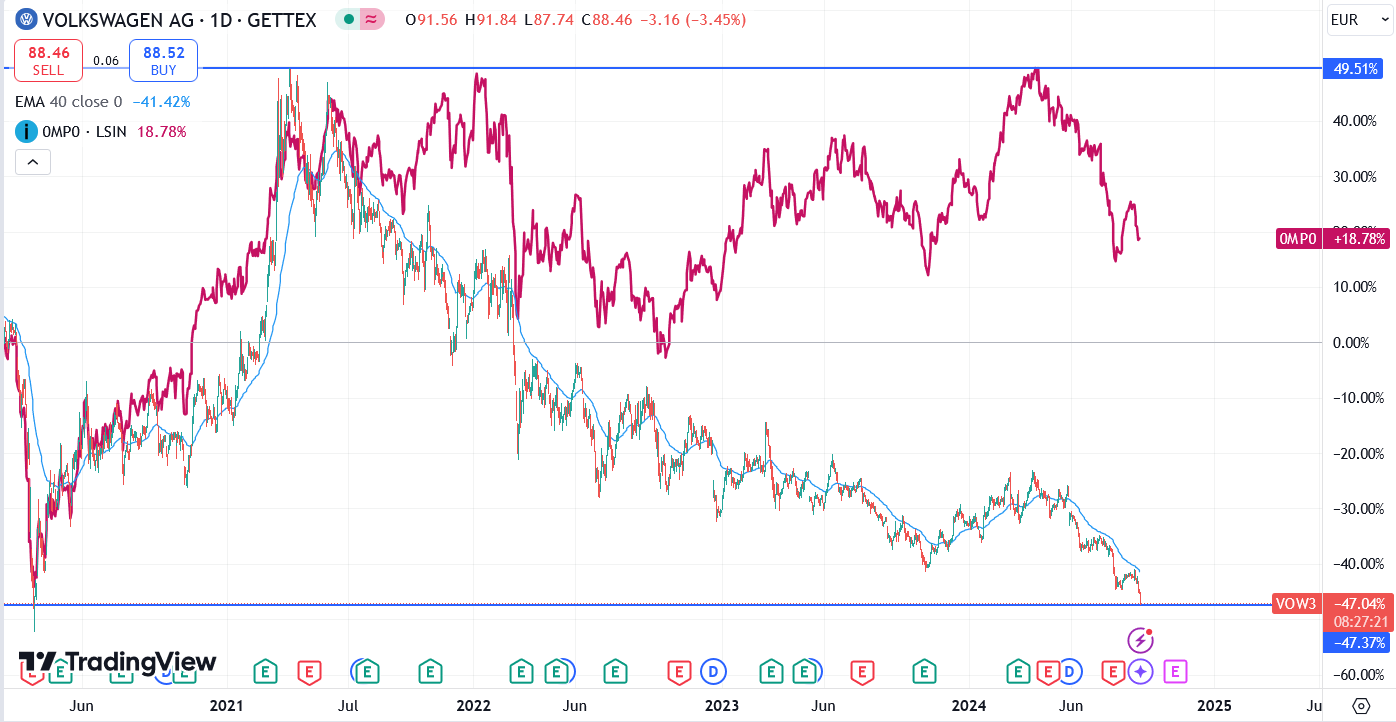

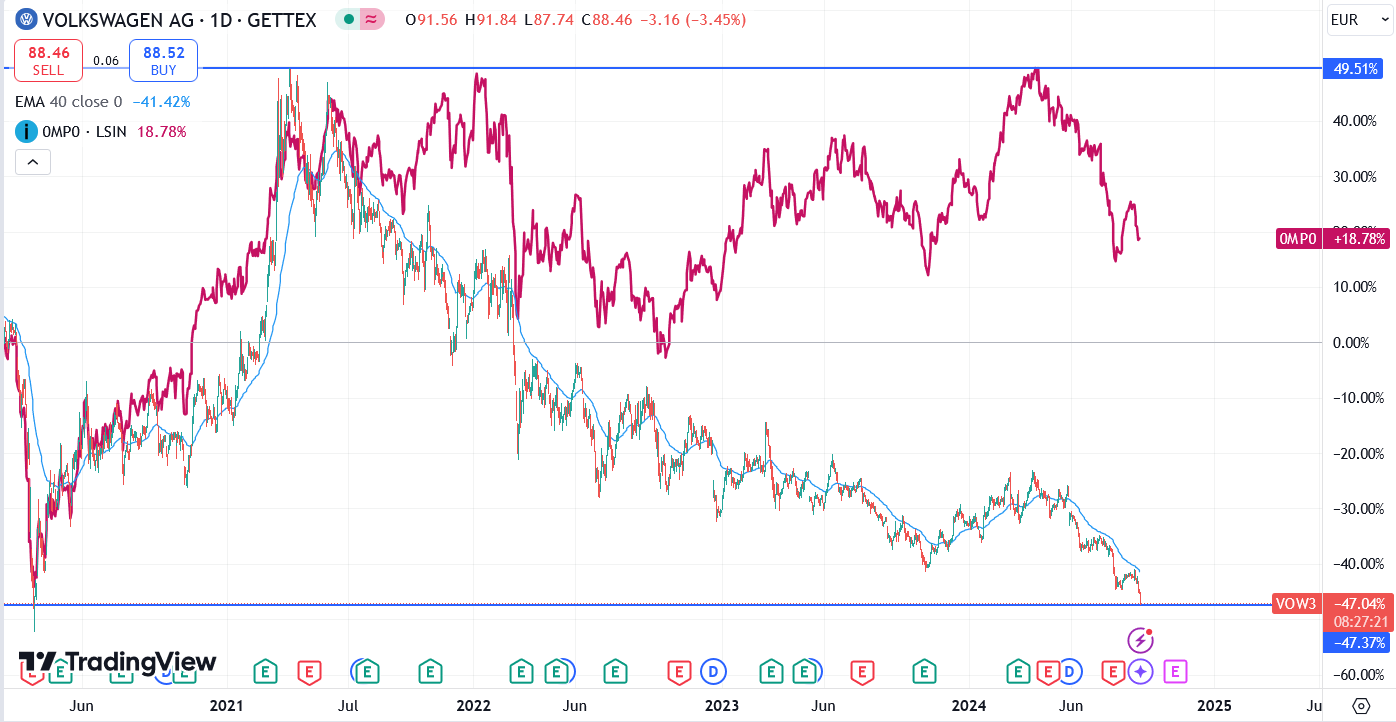

The development of Volkswagen in a chart

Below is the price chart of Volkswagen from 2017. Obvious is the dip at the COVID19 breakout in 2020 and the huge rebound through mid-2021. This was a special time with special share price results and therefore let's not be leading. However, we do see that the group's share price is currently at the same level as at the beginning of the COVID19 period. Panic selling caused the share price at that time to fall from €180 to €88. Nice starting point because that is the lowest share price since 2017.

For the complete technical picture, below you will find Volkswagen's share price performance plotted against the development of the German auto industry (dark red line). It is clear that the biggest player has been in a form crisis for some time and is lagging behind its peers. Volkswagen has had specific problems before with the so-called tampering software and thus has been struggling lately with the software for next-generation EVs.

What can we expect from Volkswagen's stock price

The biggest player has been having problems with its software for a few years now and is lagging behind its peers in valuation as a result. It fumbles there and investors don't like that. The result is at lowest share price in years. Still, Volkswagen does sell well and is second on the sales list worldwide. Moreover, the market hasbeen growing overall.

We consider Germany's largest car group capable of solving the problems. If they cannot realize this within the foreseeable future then Volkswagen will work out a rescue plan and receive support from the EU. If the EU can save Greece from disaster, than the head of Brussel will not drop the biggest car brand of the economical world.

.svg)

.webp)

.webp)

.webp)

.webp)