Publication date: Apr. 26 2024

Dutch pride since 1891.

Who doesn't know Philips? Everyone, of a certain age, has grown up with Philips products. The company has a long - and impressive history from producing light bulbs and household appliances to having a record label to manufacturing microchips and even manufacturing the famous wafers for the chip industry. The latter activity has been known as ASML since 1995.

Nowadays, the well-known parts have been privatized and the company of the inventors from Eindhoven is based in Amsterdam and focuses mainly on healthcare and medical equipment.

Thus, Philips continues the model of specializing in an emerging trend and possibly divesting it. This has already happened with the lighting division (Signify), home appliances (Versuni), and, of course, microchips (NXP) and, of course, ASML.

What can we expect from the direction Philips has taken since 2021?

Fundamentally a logical move

Philips is the only company that specializes entirely in medical devices. This is one-sided but may give the company an advantage over its competitors. Its only competitors are Siemens and General Electric. Medical equipment is not only a component but a profitable business with both competitors because of its high margin and high demand. In a large and growing medical equipment market, Philips can start to benefit as a specialist, within the limited number of suppliers. Fundamentally, it is a logical move. Yet Philips' share price has lagged sharply in recent years.

Price development of Philips: analysis and trends

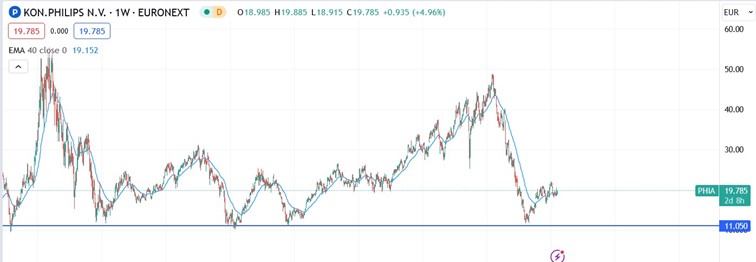

Since Philips has been listed on the stock market for a long time, it is interesting to look at a chart over the past 25 years to see the big technical picture.

Displayed on the left side is the peak reaching approximately €55. This was in the late 1990s, a period when things couldn't get any better in technology. The result was record highs on the boards in the stock markets. Subsequently came the era of the "extended downturn," followed by the financial crisis in 2008. Philips fell back to the base around €11 each time. We see this level again as the final bottom after Philips had another sharp rebound to €49. This last decline from mid-2021 was due to, among other things, the non-payment of dividends and, in addition, the extensive problems with the apnea device. As a result, Philips not only had to undertake a huge recall and lawsuits, but the affair also tarnished its stellar reputation.

From a broader perspective, it is evident that Philips experienced a significant drop from €49, finding technical support at the €11 level.

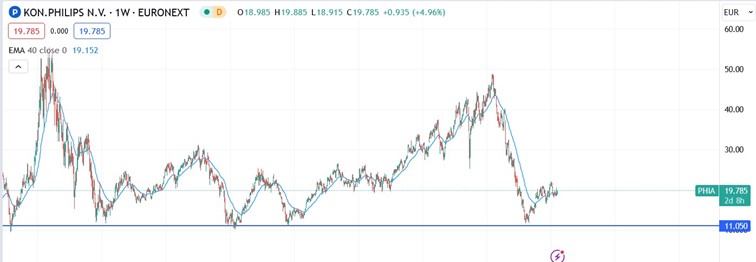

A compelling aspect to consider is the short-term technical outlook. Delving into the recovery trajectory stemming from the recent low at €11, which occurred towards the conclusion of 2022, unveils intriguing insights.

Shown in the graphic above is the upward trajectory of the stock price following the decline from €49 to €11. The stock price did not recover convincingly after an 80% price bump. Moreover, the stock market environment from December 2022 to the present was positive. This rebound can be characterized as hesitant and cautious, prompting a sense of anticipation and observation.

.svg)

.webp)

.webp)

.webp)