Publication date: June 19, 2025

In an increasingly mature crypto market, it is rare for a relatively unknown project to suddenly grab the attention of traders and investors. Yet that is exactly what Hyperliquid is doing. In recent weeks, the token's price climbed sharply. This was mainly due to increasing volume, technical momentum, and a remarkably strong community. But what exactly is Hyperliquid, why is it gaining ground, and what should investors know about it?

What is Hyperliquid?

Hyperliquid is a decentralized crypto trading exchange where people can speculate on the price movements of crypto coins without actually having to buy them. This is done through so-called perpetual futures: these are trading contracts that allow you to bet on rising or falling prices, without a fixed end date.

As with well-known platforms such as dYdX or GMX, Hyperliquid allows you to trade with leverage, which allows you to take larger positions with a smaller amount of money. You can trade here 24 hours a day, 7 days a week, without the intervention of a central party (such as a bank or brokerage firm).

What makes Hyperliquid special is that everything is done via blockchain(completely on-chain), but it feels and works just as quickly and smoothly as a regular exchange. So you get the best of both worlds:

-

Transparency and security of a decentralized solution

-

Ease of use and speed, as you would expect from a large trading platform

Hyperliquid is especially popular with active traders who like to trade cryptocurrencies with high price fluctuations (volatility) but want to keep control of their own money and data.

Why is Hyperliquid in the spotlight now?

-

Soaring trading volumes: Over the past month, Hyperliquid recorded a jump of about 40% in value, in part because more and more traders are finding the platform. In practice, the exchange's liquidity and speed are proving convincing enough to make traders switch from other platforms.

-

Technical adoption and user experience: Hyperliquid offers a fully on-chain platform that is nevertheless fast and user-friendly. Due to off-chain order matching, trades are virtually instantaneous, with low or no fees. This makes the platform attractive to active traders who expect a performance similar to that of a centralized exchange but with the advantages of decentralization.

-

Smart positioning within niche markets: Now that the price movements of large crypto tokens such as Bitcoin and Ethereum have leveled off somewhat, traders' attention is shifting to volatile, smaller tokens. Hyperliquid is cleverly capitalizing on this by supporting these very markets, with high leverage options and quick listing of new coins.

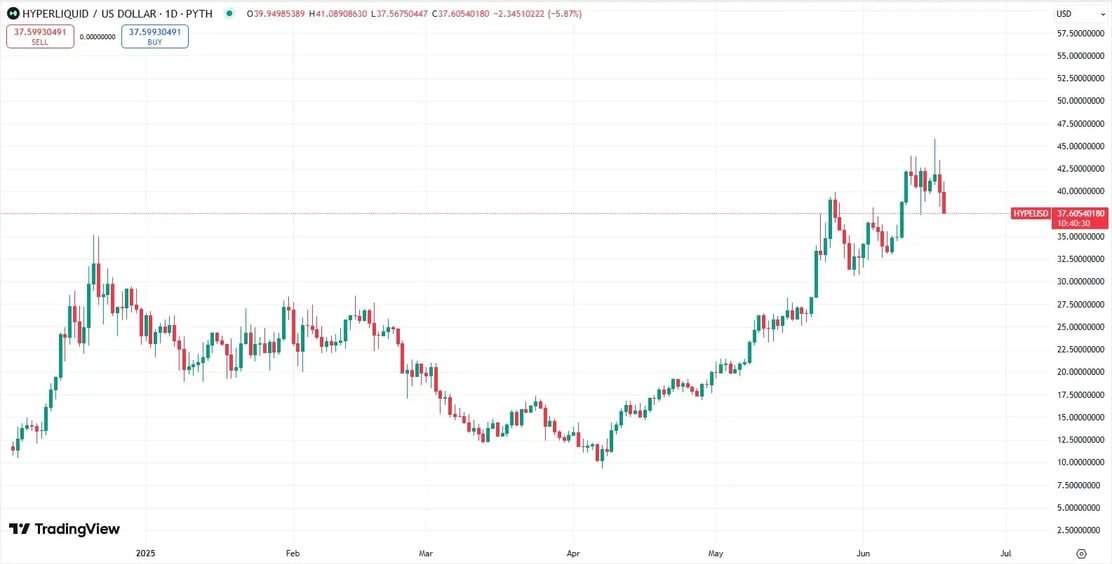

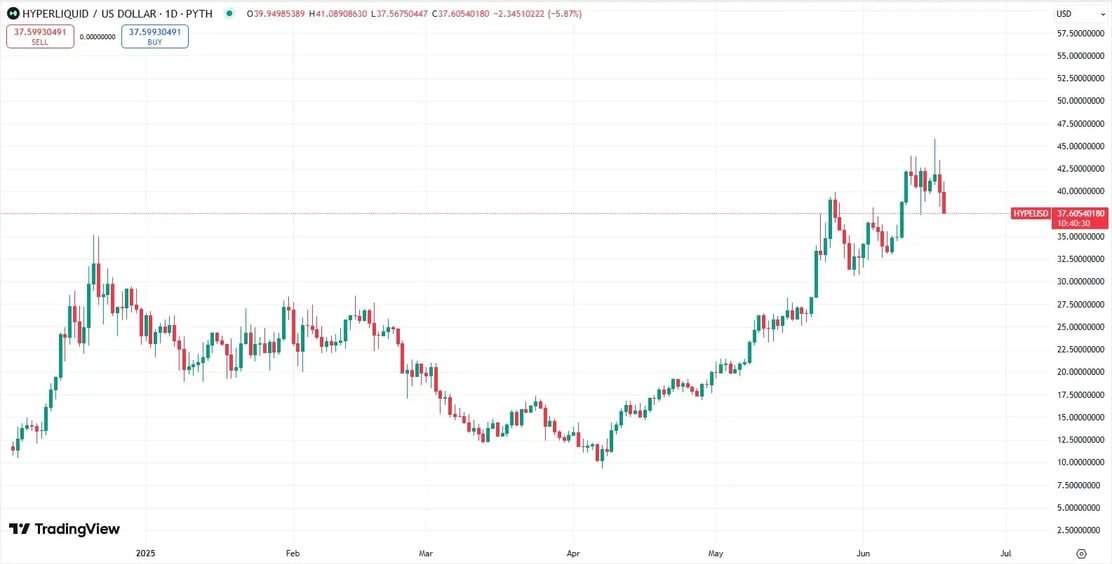

Price movement of Hyperliquid

Hyperliquid was launched on December 4 with an introductory price of $12. Within three weeks, the price managed to rise to a peak of around $35. In early 2025, sentiment in the crypto market deteriorated significantly, and Hyperliquid did not escape the correction either. On April 7, the token recorded a low of $9.40, a sharp contrast to its previous record high.

Since then, Hyperliquid has made a remarkable recovery. In just two months, the price quadrupled and reached a new high of around $45. The price currently moves between $37 - $40, holding firm. With an 11th spot in the global ranking of cryptocurrencies based on market capitalization, Hyperliquid underscores investors' growing confidence in this promising newcomer.

In the chart below, we take a look at Hyperliquid's share price movement over the past month. Exactly one month ago, the token began to show upward momentum, with the price rising from the zone around $24-$25 to a peak of $40. A pullback followed in early June, with Hyperliquid finding support at the $30.76 level. From that point, the price recovered again and reached a record high of $45.75.

Yet even this top proved short-lived. Meanwhile, the price is moving around an important support level of around $37. If this level is broken downwards, a further fall towards the earlier support around $30.76 is obvious. At that point, an upward movement could form again.

The next few days are therefore decisive: if Hyperliquid manages to stay above $37, the price could possibly stabilize around the current level. If the price falls below it, then there is a good chance that the price will fall back again towards the previous support point around $30.76, where new entry opportunities may arise.

What could drive up the price of Hyperliquid?

1. Growing trading volume on the platform: As more traders use Hyperliquid for derivatives trading, the demand for the token for fee discounts or strike, for example, increases, boosting the price.

2. Innovative technology and user experience: The combination of speed, low cost, and fully on-chain functionality makes Hyperliquid attractive to traders seeking transparency and performance.

3. Increase in DeFi interest: In a broader bull market or with increasing adoption of DeFi platforms, niche projects like Hyperliquid can benefit greatly from capital inflows.

4. Listing on major exchanges: Listing on platforms such as Binance, Coinbase, or Bybit can provide increased liquidity, visibility, and new investors.

.svg)