Price development: analysis and trends

Following the initial introduction, let's delve into the performance of the company on the stock market. What insights can we gather about its current standing and what potential outcomes can we anticipate?

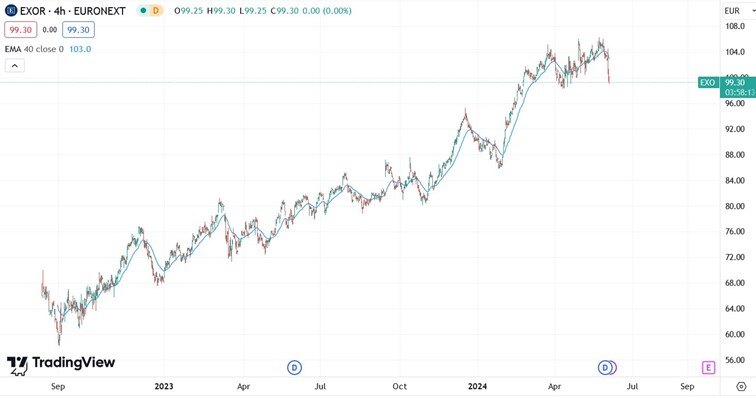

Below is the chart of EXOR since the start of its listing in Amsterdam in September 2022. The somewhat short history indicates a positive trend with a possible top forming in the last month. The last period's decline also includes a dividend payment of €0.46.

This price movement since September 2023 probably looks familiar to you. As soon as we put the AEX over EXOR we see the comparison. The price pattern has similarities but EXOR has done much better in the period since September 2022. The AEX rose over 24% and the EXOR over 45%.

We can see from the price trend that EXOR is performing much better than the AEX and its risk profile appears only slightly higher than that of the AEX.

If we zoom in on the price development over the past twelve months, we can see that EXOR's share price is showing some fatigue in its upward trend. This is also the case in the AEX. The trend is up but a correction may be imminent. This correction may allow the price to fall back to around €95 to €90. You can also see the somewhat exaggerated decline in recent days. This will first be able to recover slightly.

For the longer term, the trend is strong and upwards.

Prospects and expectations

Based on its fundamentals, EXOR is anticipated to climb to €115, with a majority of banks monitoring the stock giving it a buy recommendation.

EXOR is a strong-performing company that is spreading its investment portfolio well through its recent acquisitions. The stock outperforms the AEX and shows a similar risk and price pattern. Technically the trend is up and fundamentally the banks are positive.

The stock price seems to have started a correction which could create a possibility that the stock could start buying between €90 and €95.

Price target €115 to €120.

Disclaimer: Investing involves risks. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)