Publicatiedatum: 28 november 2024

Since Trump's election victory early this month, the media have been full of the daily revival of the crypto markets and Bitcoin in particular. Therefore, you are probably aware that Bitcoin has reached our issued price target of $100,000. That is great but we like to look ahead and therefore in this article, we pay attention to Bitcoin's forecast for the near future and its forecast for 2025.

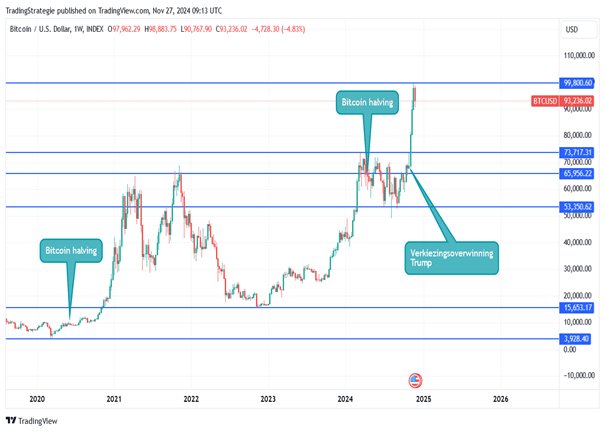

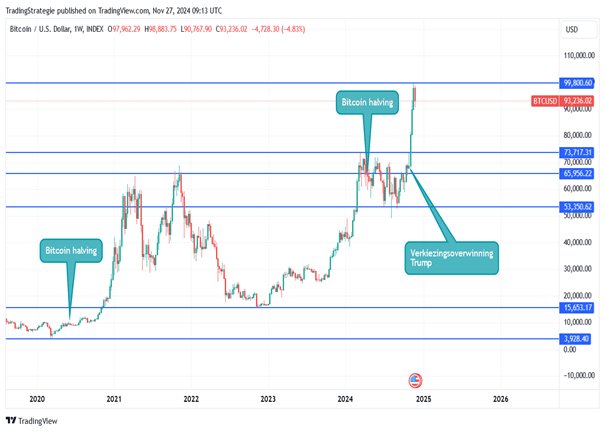

Below you will find at a glance the price movement of Bitcoin over the past 5 years. This is to get a clear picture of where we are and how it has progressed.

You can see the important "halving" moments in 2020 and 2024 and the sharp rise after Trump's victory. Currently, the price is correcting slightly from $100,000 to $93,000. Given Bitcoin's volatility, a 7% correction qualifies as a slight correction.

What is the general expectation of the Bitcoin price?

A round along the many analysts gives us a general expectation for Bitcoin that is positive, with analysts predicting significant price increases over the next few years. For 2025, predictions range between $135,000 and $300,000, with factors such as halving and increasing market adoption playing a crucial role. In the long term, toward 2030, prices of up to €450,000 are expected, in part due to the adoption of Bitcoin Spot ETFs and further institutional adoption.

What factors are playing an important and positive role in Bitcoin's price

As you may know, Bitcoin has a: limited supply: Bitcoin has a maximum supply of 21 million coins. As more coins are mined, the supply becomes scarcer, which can increase the price with increasing demand. This rising demand may come from increasing adoption by individuals, businesses, and governments. Donald Trump has indicated he will relax regulations regarding crypto. Positive regulations, such as tax breaks or recognizing Bitcoin as legal tender, could push the price up. Among other things, Trump has proposed setting up a strategic Bitcoin reserve for the US. Big companies and mutual funds buying Bitcoin or launching Bitcoin ETFs are boosting confidence and increasing demand. Trump's re-election has led to an increase in institutional investment in the crypto market. BlackRock's Bitcoin ETF reached a new high on Nov. 6 with the highest trading volume to date: $4.1 billion in assets traded in a single day.

What is the risk of the rise of Bitcoin's share price?

As described above, many signs are green. Still, there are a few things we should keep in mind. Despite cybersecurity improvements, scandals or hacks can damage confidence in the network and negatively affect the price.

Alternative coins (altcoins) that offer better technologies or are more attractive to investors may reduce demand for Bitcoin. Great investors (whales) can influence the price with their transactions, and influential figures (e.g., Elon Musk) and trends on social platforms can also drastically affect the price.

These are factors to keep in mind but are not labeled by us as a significant risk to Bitcoin's rising price.

.svg)

.webp)

.webp)

.webp)