Publication date: July 4, 2025

Nokia is a pioneer within telecom infrastructure and an established name in European stock markets. In this article, you will discover all about Nokia stock: share price performance, strategic transformations and future expectations. Are you considering investing in technology and connectivity? Then sign up for our newsletter here and always stay up to date.

- Year of establishment: 1865

- Year added to the EUROSTOXX 50: 1998

- Highest price ever: €65 in June 2000

- Average trading volume: Approximately 8.3 million shares per day

- Price performance over the past 12 months: +21.28%

Introduction about the company

Nokia Corporation was founded in 1865 with its headquarters in Espoo, Finland. Nokia is a global player in telecom infrastructure, mobile networks and technology licensing. Where the brand used to be synonymous with cell phones, today it is a leading provider of 5G networks, digital innovation and cloud-based solutions. Nokia provides services to major telecom providers and industrial customers in more than 130 countries.

Key figures & achievements

In 2024, Nokia achieved sales of €19.2 billion, down slightly from the previous year. Net profit was €2.41 billion, a large increase over 2023. The Network Infrastructure segment in particular showed strong growth of 17%. The market capitalization in mid-June 2025 was about €24.23 billion. Nokia has more than 80,000 employees worldwide.

History & development

Nokia began in the 19th century as a paper manufacturer and evolved through rubber and cables to consumer electronics and cell phones. In the 1990s and early 2000s, it grew to become the market leader in mobile phones. After selling its mobile division to Microsoft in 2014, the focus shifted to network solutions. Today, Nokia is back on the map as an innovator in 5G, edge computing and telecom infrastructure. Its recent acquisition of U.S.-based Infinera should further increase its technological lead.

Sector & competition

Nokia operates in the global telecom sector, in which it competes with companies such as Ericsson, Huawei and Cisco. Within this sector, Nokia focuses on infrastructure solutions, from antennas to core networks, as well as licensing models and software. The market is fast-moving with the global rollout of 5G networks, the emergence of private enterprise 5G and geopolitical tensions around vendor choices. Thanks to broad geographic coverage and innovativeness, Nokia knows how to position itself well.

Nokia's influence on the EURO STOXX 50

Nokia has been part of the EURO STOXX 50 since its inception in 1998. In December 2024, Nokia represented a weighting of about 0.65%, making a small but stable contribution within the technology sector. Curious about the full composition of the EURO STOXX 50? Read all about it here. The share price is influenced by international tenders, margins on network equipment, currency developments and geopolitical tensions. Renewed profitability and focus on North American growth support confidence in the stock.

Investment analysis & outlook

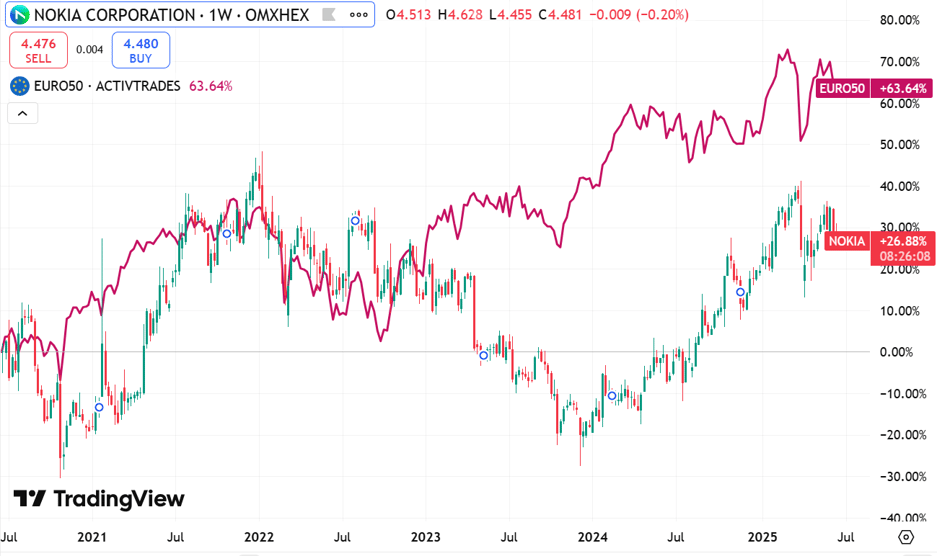

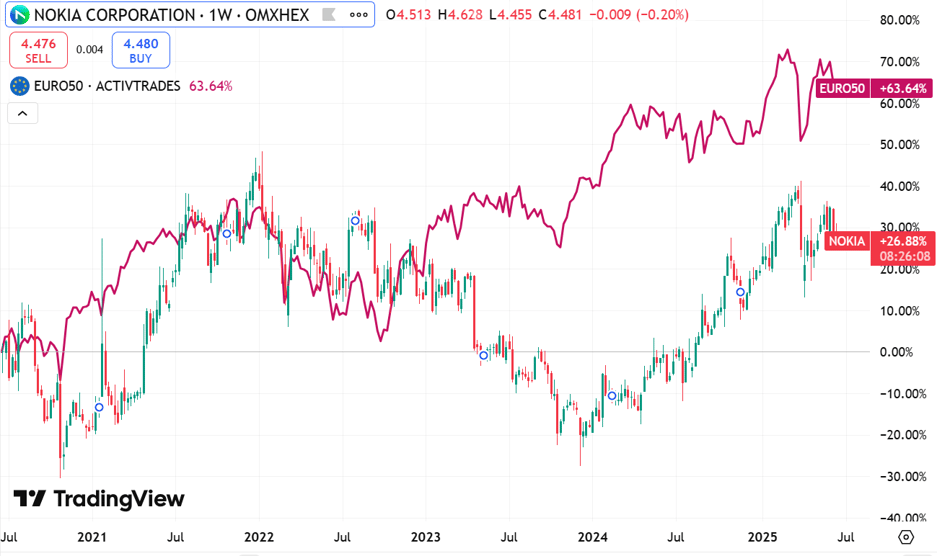

Below is Nokia's share price performance compared to the EURO STOXX 50 over the past five years. Whereas the index posted a return of +63.64%, Nokia lagged sharply behind with a +26.88% rise. The dip in 2023 and the recovery from 2024 illustrate the cyclical nature of the telecom infrastructure market.

Still, there are signs of structural improvement. In Q4 2024, Nokia returned to profitability with an operating profit of €813 million. The Infinera acquisition should eventually contribute to net profit growth of more than 10% a year. For all of 2025, the company anticipates an operating profit between €1.9 billion and €2.4 billion. With continued investment in 5G, private networks and technology licensing, Nokia seems poised to grow structurally again.

News & updates

2025, Nokia confirmed its strategic repositioning with the acquisition of Infinera, an optical networking specialist. The transaction, worth approximately €2.1 billion, provides economies of scale and strengthens its North American position.

In addition, a new technology center was opened in Dallas, focused on collaboration with hyperscalers such as Google and Amazon Web Services. Furthermore, Nokia expanded its licensing portfolio with AI patents in the field of edge computing, again underscoring its role as an innovator.

With these moves, Nokia remains well-positioned in a rapidly evolving market, where connectivity, digital infrastructure and sustainability are increasingly important.

For more information about Nokia, please visit:

www.nokia.com

Disclaimer: Investing involves risk. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)