Influence of RELX on the AEX

RELX has a significant influence on the AEX, with a weighting of approximately 8.69% (measured in 2024). As one of the largest companies in the index, RELX plays an important role in determining the overall performance of the AEX. RELX's share price movements are often influenced by demand for data services, macroeconomic trends, and investments in emerging technologies. The stock is considered a defensive choice within the index due to the company's stable revenue streams. View the composition of the AEX here and discover the weighting of all companies within the index.

Investment analysis & outlook

RELX is considered a solid investment by analysts, thanks to its consistent revenue growth, profitability, and strong market dynamics. The company is benefiting from megatrends such as digitization, automation, and the growing need for risk management solutions. Risks include potential slowdowns in economic growth, increasing competition, and regulatory pressure in certain markets.

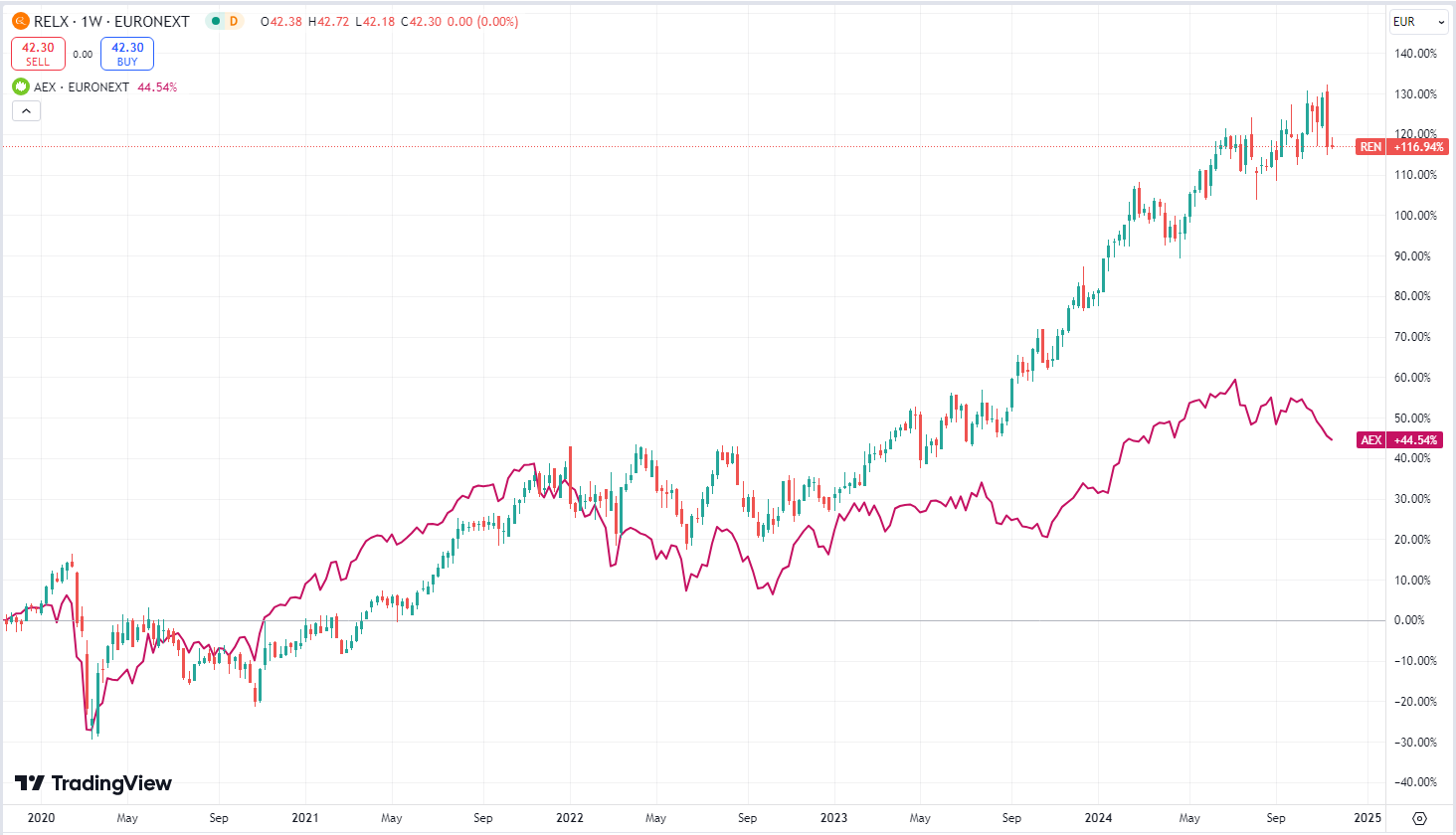

Below is RELX's share price performance compared to the AEX over the past five years. This shows that RELX has shown consistent growth, with less volatility than many other AEX-listed companies. Moreover, the comparison shows that RELX has grown significantly more than the AEX.

News & updates

Recently, RELX announced that it is further expanding its focus on artificial intelligence, with new applications for legal and medical clients. The company is also investing in the development of its leading platforms such as LexisNexis and Elsevier ScienceDirect, which support increasing demand for data-driven solutions. In addition, RELX is considering expansion in Asian markets, where it has already shown significant growth.

For more information on RELX's performance and strategic plans, please visit its official website: RELX.com.

Disclaimer: Investing involves risk. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)

.webp)