Influence of ASR Netherlands on the AEX

As one of the largest insurers on the Amsterdam stock exchange, ASR Netherlands nevertheless has only a relatively small influence on the AEX index, with a total weighting of only 0.71% (measured June 28, 2024). This is because the weighting depends on market capitalization. As a result, ASR Nederland's figures will have a limited impact on the entire AEX index. Nevertheless, share price movements may affect the index, especially during the release of quarterly results and other important corporate developments. View the composition of the AEX here and discover the weighting of all companies within the index.

Investment analysis & outlook

Investment analysts consider ASR Netherlands to be a stable investment, given its strong market position and ability to adapt to changing market conditions. Its focus on sustainability and innovation offers growth potential, although factors such as economic uncertainties and competitive pressures may pose challenges. Following the successful acquisition of Aegon, ASR Nederland's ambition is to become the leading insurer in the Netherlands.

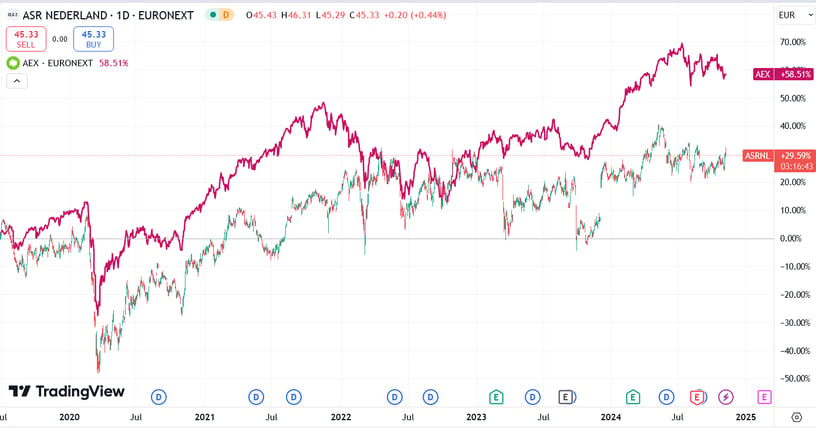

The chart below shows the price performance of ASR Nederland against the AEX index over the past 5 years. It clearly shows that, after a significant decline in the early 2020s, the company has made an advance towards better figures in recent years. The better performance of the AEX is mainly due to the major influence of well-performing tech funds.

News & updates

Recently, ASR Netherlands announced the optimization of its industrial network by closing three production sites and transferring production to other regional locations. This consolidation is part of the company's multi-year efficiency plan, which is expected to be completed by the end of 2026. For more details on ASR Netherlands' financial performance and initiatives, visit its official website: ASR Netherlands.

Disclaimer: Investing involves risk. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)

.webp)