BNP Paribas' influence on the EURO STOXX 50

BNP Paribas has a weighting of 1.80% in the EURO STOXX 50 (reference date: December 2024), placing it in the middle category within the index. View the composition of the EURO STOXX 50 and the weighting of all companies here. BNP Paribas' share price is influenced by several factors, including interest rates, economic growth, monetary policy changes and regulations within the European financial sector.

Investment analysis & outlook

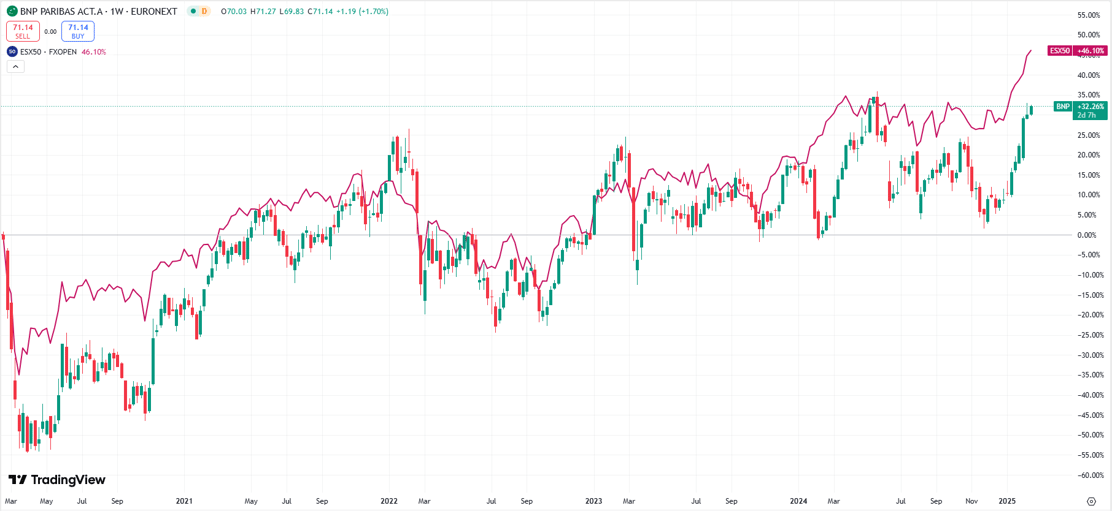

Below is BNP Paribas' share price performance compared to the EURO STOXX 50 over the past five years. While the index posted a return of +46.10%, BNP Paribas performed with a gain of +32.26%, indicating stable growth despite challenges in the banking sector.

BNP Paribas benefits from rising interest income and growing demand for digital and sustainable banking services. At the same time, the bank remains exposed to tighter regulations and economic uncertainties in Europe. Management has ambitious plans to accelerate its digital transformation and expand sustainable project financing by €200 billion by 2025.

News & updates

Recently, BNP Paribas announced a partnership with Google Cloud to integrate AI and data analytics into its digital banking services. In addition, the bank is expanding its green financing programs, investing €10 billion in sustainable infrastructure projects in Europe and Asia.

With a strong focus on innovation, ESG investments and digital transformation, BNP Paribas remains well positioned for the future. For more information about the company, visit www.bnpparibas.com.

Disclaimer: Investing involves risk. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)