Price movement AEX Index

It's Friday, March 8th, and in the morning, the AEX stands at 868. That's 20 points higher than a week ago.

Below is the chart of the AEX since the beginning of this year. You can see the strong upward movement, particularly in January driven by the Tech stocks. Additionally, there's a net sideways movement in February. On Thursday, March 7th, the AEX broke out and may be on its way to the next target of 920.

What is the expected trend for the AEX Index?

On Thursday, we experienced several macroeconomic events, along with speeches from both Ms. Lagarde (ECB) and Mr. Powell (FED). Particularly, Powell's speech on Thursday afternoon provided a boost to the stock markets. By indicating that the US is not far from a rate cut, the market gained momentum.

Consequently, the AEX broke through the significant barrier of 861, straight to 872. It's only 3 points away from the initial target. The trend is strong and upward, although the target for this trend in 2024 has been revised down from 950 to 920.

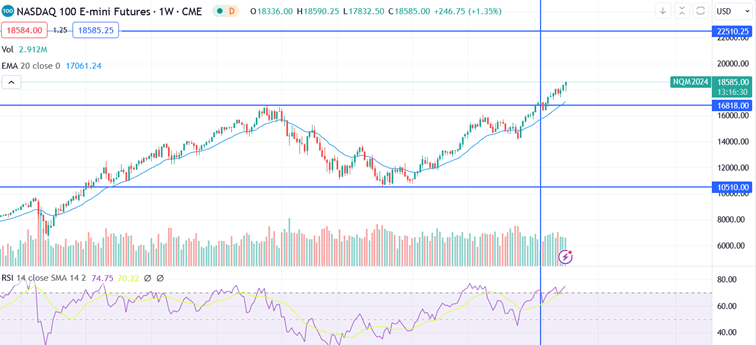

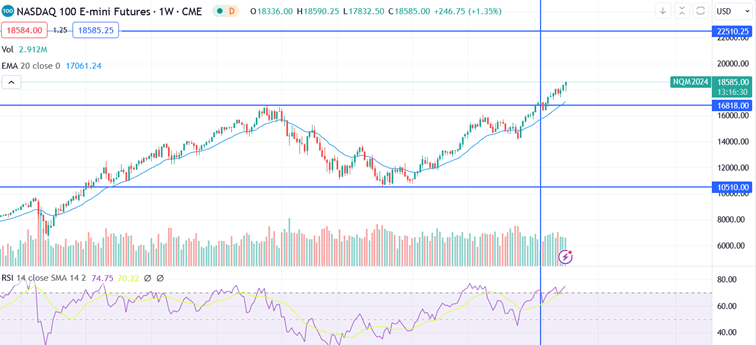

What is the Expected Trend for the Nasdaq?

Above is the chart of the Nasdaq100 since the beginning of 2020, clearly illustrating the strong upward trend since the COVID period. There's been an inevitable correction and, of course, the current upward trend due to the substantial growth and expectations of the Tech stocks. Currently, the Nasdaq is at 18,500, approximately 500 points higher than the end of last week. The same principles apply to the Nasdaq as to the AEX. Although the Nasdaq's price movements are larger and more volatile, the trend and scenario are similar. Hence, the algorithm took a long position here on February 22nd. The initial target for the Nasdaq is 19,000, with an ultimate target price for 2024 of 22,500.

.svg)

.webp)

.webp)

.webp)