Publication date: July 17, 2025

It is Thursday, July 17. The AEX is at 915 in the opening session. That is 10 points (1.1%) lower than last week's reading.

What happened on the AEX in the past week?

After President Trump announced new import tariffs for the EU over the weekend, it seemed for a while that EU markets would open lower on Monday. The fears proved unfounded and the AEX opened quietly at 918. The Index then advanced to its weekly high at 927.

On Wednesday, heavyweight ASML released figures and expectations. These were not appreciated by investors, causing ASML to lose more than 10%. The drop in ASML already caused a 1.5% decline in the AEX on Wednesday.

The low was set Wednesday just before the close at 902 when Trump once again came out with an announcement. He indicated he was going to fire Fed Chairman Powell. The market quickly dropped a percent but after Trump indicated that Powell will not be fired (for now) after all, stock markets recovered quickly.

What does this mean for sentiment on the AEX?

Underlying sentiment on the AEX is positive but uncertainty remains regarding the impact of trade barriers and geopolitical tensions.

What is the outlook for the AEX?

The longer-term outlook is unchanged positive. In the most likely scenario of our algorithm, the AEX is going to rise to the price target 1,050. Because of the long period during which the AEX moves within a sideways pattern and the increased uncertainty, our algorithm gives an increased possibility of a short slip to around 880.

This does not affect the positive scenario. Hence, the stoploss remains wide at 870. In the ride to the price target, we should expect some resistance around 935 and 950.

Above is the chart of the AEX from early 2025 showing the sideways pattern since mid-May. The arrows indicate the most likely scenario for the coming months.

What happened on the Nasdaq this past week?

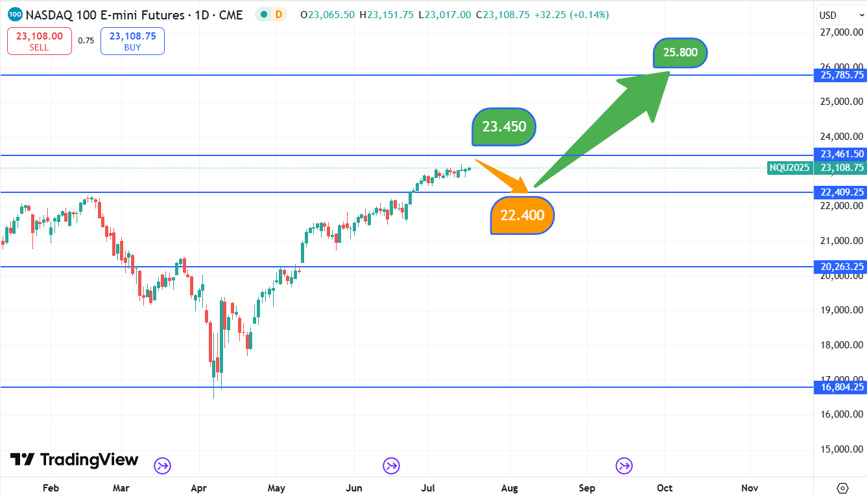

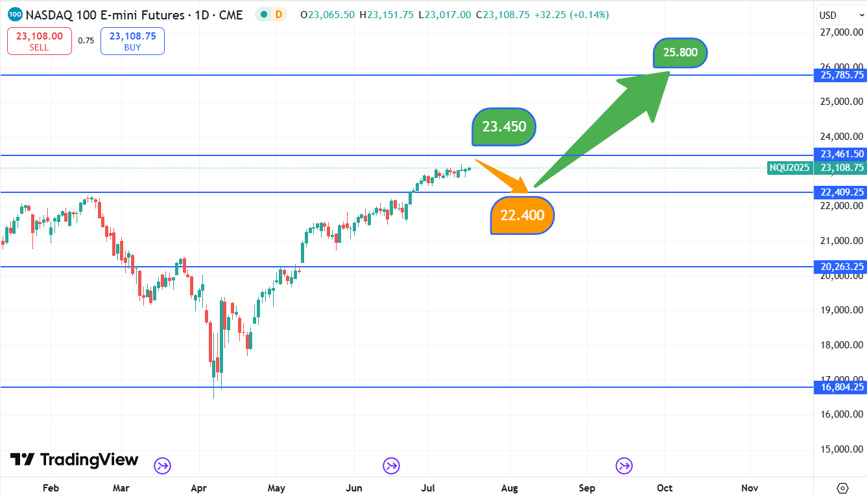

The Nasdaq futures are at 23,110 on Thursday morning, July 17 which is 80 points (0.35%) higher than last week.

The Nasdaq futures performed rather flat last week. The future opened the week slightly lower but did reach a high later in the week at 23,222. As previously reported, the Nasdaq is losing some momentum and this was evident again last week.

What is the outlook for the Nasdaq futures?

Unchanged positive. In the most likely scenario, the Nasdaq future will pull out one last preliminary sprint to around 23,450. This move will be followed by a correction to around 22,400 before continuing to rise to the price target at 25,800.

In the correction, a consideration to take a buy position arises. Below is the chart of the Nasdaq futures from early 2025 with the most likely scenario.

What happened on the Dow Jones Industrial Average (DJIA) Index this past week?

The DJIA is currently trading at 44,415 points, which is 210 points (0.45%) lower than last week's reading.

The DJIA is performing weakly and has been correcting since reaching our stated price target at 45,200. The DJIA opened the week slightly lower at 44,365 and dropped slightly during the week to 43,970.

.svg)

.webp)

.webp)

.webp)