Publication date: May 8, 2025

Raydium (RAY) is an important trading platform within the Solana network. It acts as a digital marketplace where you can automatically buy and sell crypto without the need of another person. This type of system is called an AMM (Automated Market Maker).

Raydium was developed specifically for Solana, one of the largest and fastest blockchains in the crypto world. Solana enables fast and cheap transactions, which is essential for platforms like Raydium. We at Yelza have already written about this powerful Layer 1 blockchain before; read our in-depth article from March 13, 2025, here.

What makes Raydium special is that it not only uses its own system, but also connects to Serum, another major exchange on Solana. This allows users to benefit from faster transactions, lower fees and better prices than on many other platforms, such as those on Ethereum.

Raydium plays a central role in the Solana ecosystem. It helps with:

-

starting new projects (IDOs),

-

earning interest with crypto (yield farming),

-

and building other apps on the blockchain (dApps).

Thanks to these features and the high speed of Solana, Raydium has become one of the key components of the Solana blockchain.

How does Raydium work?

Raydium is special because it combines two ways of trading. On the one hand, it lets you trade crypto directly through automated systems (AMMs), and on the other hand, it also uses prices from a major exchange on Solana called Serum. As a result, you often get a better price and can trade faster.

These are the main features of Raydium:

-

Swap: Swap crypto tokens with each other quickly and cheaply, thanks to the high speed of the Solana network.

-

Farm: Lock your tokens into so-called pools and earn rewards automatically.

-

Acceleraytor: A launch pad for new Solana projects. Here, people can invest in new tokens even before they hit the market (via an IDO).

-

Fusion Pools: Special reward pools that cooperate with other projects, so you can earn extra returns.

Raydium's own currency is called $RAY. It is used to vote on decisions (governance), for staking (earn rewards by locking in coins), and as a reward for active users.

What is an AMM?

An AMM, which stands for Automated Market Maker is a smart system that allows crypto to be bought or sold automatically, without the need for a direct counterparty. Rather than relying on an order book to match supply and demand like a traditional exchange, an AMM employs an algorithm to continuously determine pricing.

In this process, you trade against a so-called liquidity pool: a digital pot containing two types of coins, such as SOL and USDC. When you purchase or sell one of these coins, the pool's ratio adjusts, leading to a change in price.

This system makes it possible to trade crypto 24/7, quickly and without intermediaries. Examples of popular AMMs are Uniswap, PancakeSwap, and Curve.

Recent developments

Raydium is consistently evolving to align with the expansion of the Solana network. Notably, since 2024, significant changes have occurred. Below, we clearly outline the most important innovations:

-

New look and ease of use: In early 2025, Raydium received a major update to its website and app. The updated design and clearer menu now make it easier for new users to start trading or farming.

-

Collaborations with popular projects: Raydium is increasingly collaborating with well-known projects on Solana, such as NFT platform Tensor and the game Star Atlas. This provides more use and visibility for Raydium.

-

Access for other blockchains: Thanks to a partnership with Wormhole, people from other blockchains (such as Ethereum and BNB Chain) can now use Raydium. This means more users and more liquidity.

-

More say for users: In March 2025, it was decided that people who hold their $RAY tokens for a long time will have more voting power over decisions within Raydium. This will give the community more influence.

Raydium continues to grow and improve. With new features, better accessibility, and more community involvement, the platform is taking steps toward a broader and stronger future within the Solana world.

Share price performance and market sentiment

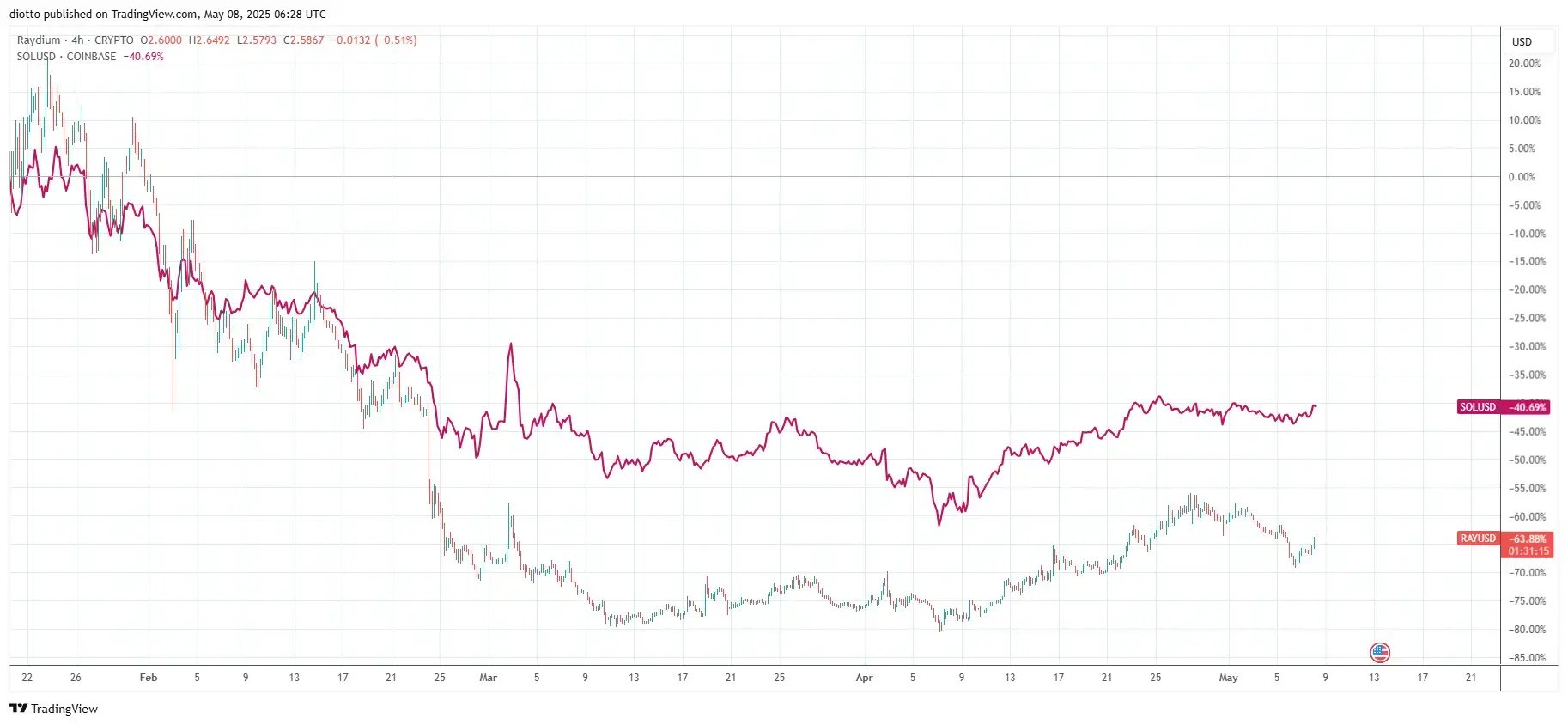

Given Raydium's role within the Solana network, we see a clear correlation between share price movement. Since late January, however, Raydium has fallen deeper than Solana.

Raydium's sharp price drop in late February 2025 was mainly caused by rumors that the Solana-based memecoin launchpad, Pump. Fun was developing its own Automated Market Maker (AMM). This would mean that tokens previously traded through Raydium would now potentially have their liquidity pools, jeopardizing Raydium's role as the primary AMM for these tokens.

Some analysts considered the market reaction exaggerated. Given that only a small percentage of tokens are launched through Pump. fun, and the overall trading volume of these tokens is relatively low. Still, the speculation was enough to cause significant selling pressure

Meanwhile, recovery has resumed, and the two currencies are following a similar bullish pattern.

What could be driving up the price of Raydium?

1. Revival of Solana: The rise of Solana as a fast and cheap alternative to Ethereum provides Raydium with a strong base to grow on.

2. Rising TVL and DeFi usage: More users in DeFi means more demand for liquidity, and thus more use of Raydium.

3. IDOs and new launches: Raydium's function as a launchpad remains attractive for new projects, generating additional attention and volume.

4. Interoperability via Wormhole: More connections to other chains can provide greater user flows.

.svg)