Publication date: May 24, 2024

AMG Critical Materials NV was founded in 2006 but the history of its predecessors dates back to 1870. The company is engaged in manufacturing metallurgical products and systems. These include the manufacture of special metals and chemicals for the transport and energy sectors and even for space travel. AMG has about 3,500 employees and sales of €1.5 billion. AMG has had a stock exchange listing since 2007.

AMG was a very popular stock, especially until last summer. Not surprising given its huge rise. Currently, the share price is sharply lower again. Many investors have therefore gone through a lot with AMG shares in the past year and it is interesting to take a closer look at the stock to assess the near future.

Let's first consider how the share price has fared over the past seven years.

What is immediately noticeable is the huge rise in 2017-2018 from €14 to €52. Then back to € 14.- in 2020. This is followed by a period of movement until the summer of 2023 when the old top is approached but the price bounces off at €50. From July 2023 onwards, the price gradually declines to its current mark of approximately €20.

In our opinion, AMG thus qualifies as a risky share with great potential but also with considerable risks. Why is this and how can we deal with it and possibly profit from it?

Price development: analysis and trends

The reason for the high volatility is that AMG is dependent on the price of raw materials. In particular, the price of Lithium is important. The price of commodities is almost always highly volatile and carries increased risk.

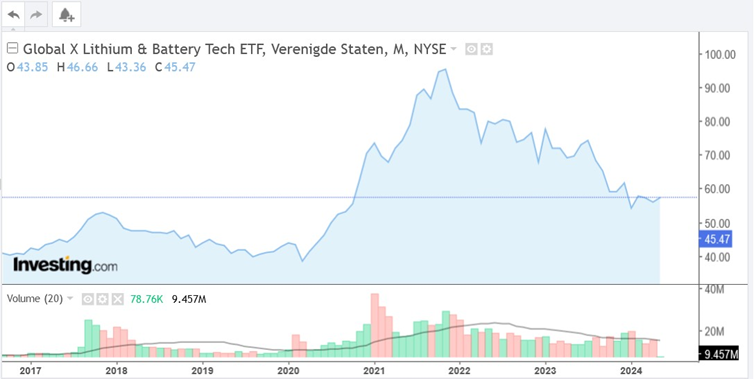

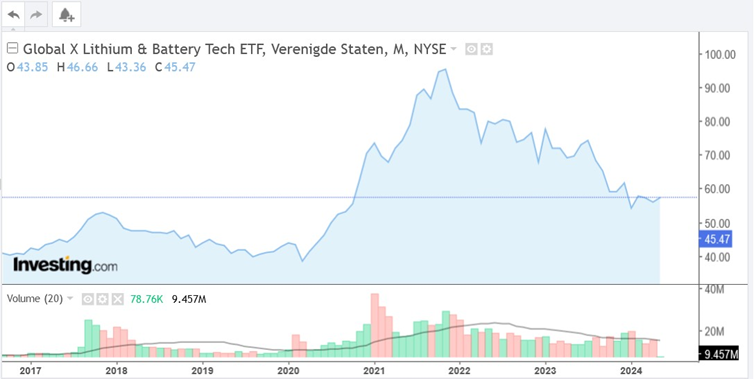

Below is the price of Lithium over the past seven years.

You can see that there is some correlation between the price movement of Lithium and that of AMG which means that AMG's success depends to a considerable extent on the price movement of commodities, in this case, Lithium. This fact is, in our opinion, too high a risk to invest in AMG.

At the presentation of its figures, AMG has already indicated that it is taking into account deteriorating market conditions in 2024. So this warning is already factored into the current share price.

Technically, the share price is weak. After the share price bump from €50 to €16 in the past year, there is a cautious technical recovery that already seems to be completed based on pattern recognition.

Conclusion

AMG, according to our findings, is a stock with higher than average risk due to its dependence on the volatile commodity market. This risk means that there are also periods when the stock goes up tremendously but in general it is highly volatile and experiences large price declines.

The current technical recovery is fragile and appears rounded.

Lithium is a highly demanded commodity but is not a very scarce commodity. Moreover, alternatives to Lithium are being worked on in the market.

For investors who believe in Lithium and are speculatively inclined, this stock is worth considering. After all, the price is around an all-time low and a lot of bad news has already been processed. Considering our analysis, the level of risk associated with this stock is deemed too significant, leading us to opt out of investing in it.

July 31 AMG will come out with figures. We are curious to see if AMG's warning about market developments has come true and how the company is handling it.

Disclaimer: Investing involves risks. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' own insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)