Deutsche bank's influence on the DAX 40

Deutsche Bank has a significant weighting within the DAX 40 index. As of June 2025, it stood at approximately 2.84%. View the composition of the DAX 40 and the weighting of all companies in the DAX 40 here. As a major bank, Deutsche Bank's share price movements directly influence the performance of the main German index. Developments mainly influence the share price in interest rates, global capital flows, regulations and geopolitical tensions. In addition, market sentiment around investment banking and the outlook for the European economy are key.

Investment analysis & outlook

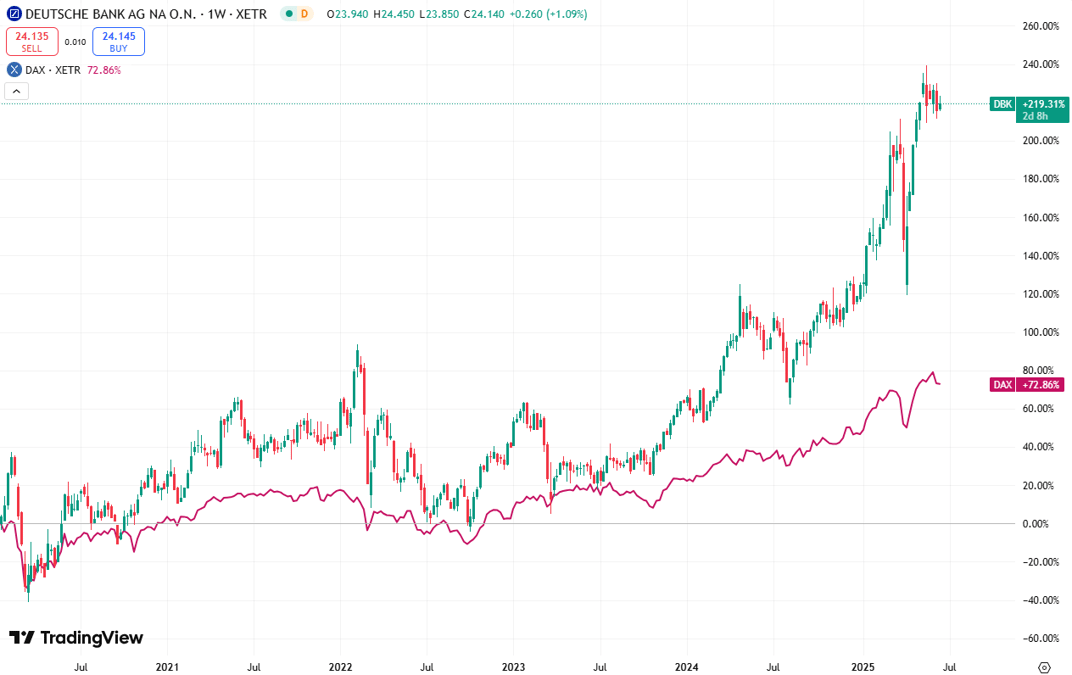

The chart below shows the price performance of Deutsche Bank (DBK) relative to the DAX Index (DAX) over five years. What is striking is that Deutsche Bank has outperformed the index by a wide margin since mid-2023. While the DAX has risen about +73% since 2020, Deutsche Bank shares are at an impressive +219%.

The strong share price performance reflects the bank's recovery in 2024. The deployed strategy is starting to pay off, particularly through higher interest income, a more efficient cost structure and growth in services to large corporations. In addition, Deutsche Bank has benefited from recovering confidence in European banks, thanks in part to stricter regulation and robust supervision.

Looking ahead to 2025, Deutsche Bank remains committed to digitalization, cost control, and strengthening its asset management business. At the same time, the bank remains sensitive to international fluctuations in capital markets and macroeconomic risks. Should the European economy remain stable, there is room for further share price growth and recovery of dividend payments.

News & updates

In April 2025, Deutsche Bank announced it will invest €2 billion in its digital infrastructure, focusing on automation, data security and artificial intelligence in customer-facing processes. The bank also introduced new ESG-related credit lines and further expanded its sustainable finance portfolio.

In the same quarter, the board confirmed a dividend proposal of €0.45 per share, a sign of confidence in profitability and financial stability. Deutsche Bank aims to further establish itself as a leading partner for sustainable investments and innovative financial solutions in a changing economic landscape.

For more information about Deutsche Bank, please visit: https://www.deutschebank.be/nl/

Disclaimer: Investing involves risk. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts' insights and experiences. They are therefore for educational purposes only.

.svg)

.webp)

.webp)

.webp)