Publication date: October 16,

Chainlink (LINK) is a leading decentralized oracle network that connects smart contracts with external data. In this article, we cover LINK’s price developments, technology, and outlook. Want to learn more about Chainlink and other cryptocurrencies? Sign up for our newsletter here and stay informed.

What is Chainlink?

Chainlink is a cryptocurrency (Crypto overview page) project focused on connecting smart contracts with the real world. Smart contracts, which operate on platforms like Ethereum, cannot independently access external data such as asset prices, weather information, or other real-world data. This significantly limits the functionality of smart contracts. Chainlink provides a solution by using oracles, which act as intermediaries to bring real-world data to the blockchain. For example, it can provide weather forecasts for agricultural insurance contracts, where automatic payouts can be triggered based on weather conditions.

Oracles , however, are only one aspect of Chainlink. The project has built an entire network of decentralized oracles, with several independent operators providing data to ensure reliability and security. This infrastructure is essential, especially in sectors such as decentralized finance (DeFi), where accurate and up-to-date data is crucial to the execution of financial contracts.

.webp)

How does Chainlink work?

The operation of Chainlink is based on a network of oracles that bring external data to smart contracts. When a smart contract needs specific information, for example, the price of Bitcoin in dollars, it sends a request to the Chainlink network. This request is distributed to multiple oracles, which independently retrieve the same data. This data is then combined to provide the most accurate and reliable version for the smart contract.

The Chainlink token (LINK) is used to reward node operators for providing reliable data. Node operators are individuals or entities responsible for running Oracle software within the Chainlink network. They retrieve data from external sources and deliver it to smart contracts. To ensure the quality of this data, node operators are rewarded with LINK tokens if they provide accurate and reliable information, which is crucial for the operation of the smart contracts that depend on this data.

History of Chainlink

Chainlink was founded in 2017 by Sergey Nazarov and Steve Ellis. The project quickly gained attention for its unique solution to the problem of external data in smart contracts. In 2019, the first major milestone occurred with the launch of the mainnet on Ethereum. This paved the way for widespread adoption of the Chainlink network.

In the following years, Chainlink rapidly expanded its ecosystem. The project entered into major collaborations with technology companies such as Google Cloud and Oracle, strengthening its position in the market. These partnerships allowed Chainlink to be recognized not only within the crypto world but also by major companies in the traditional technology and financial sectors.

Another important development was the implementation of new features such as Chainlink VRF (Verifiable Random Function) and Chainlink Keepers. These tools further expand the capabilities of smart contracts by allowing them to access random data and perform specific actions automatically. Thanks to these innovations, Chainlink remains one of the most versatile platforms in the crypto world.

What's going on at Chainlink

Recently, there have been several developments around Chainlink that continue to shape its future. Despite LINK's price declines, the development area remains very active. According to data from blockchain analytics platform Santiment, Chainlink continues to lead in development activity within the ERC-20 ecosystems, with more than 600 significant GitHub updates in the past 30 days. This means that the team is working without interruption on improvements and new features, even during periods of market correction.

In addition, Chainlink has recently announced significant collaborations, including a partnership with Swift, the international financial network. This partnership strengthens Chainlink's position as a bridge between traditional finance and blockchain technology, further promoting the integration of smart contracts with the global banking system.

Another interesting development is the growth of Chainlink's social dominance. This includes increased discussion of the project on social media and in online forums. This increased attention can potentially contribute to greater confidence in the future of the project, despite changing market conditions.

Price development of Chainlink

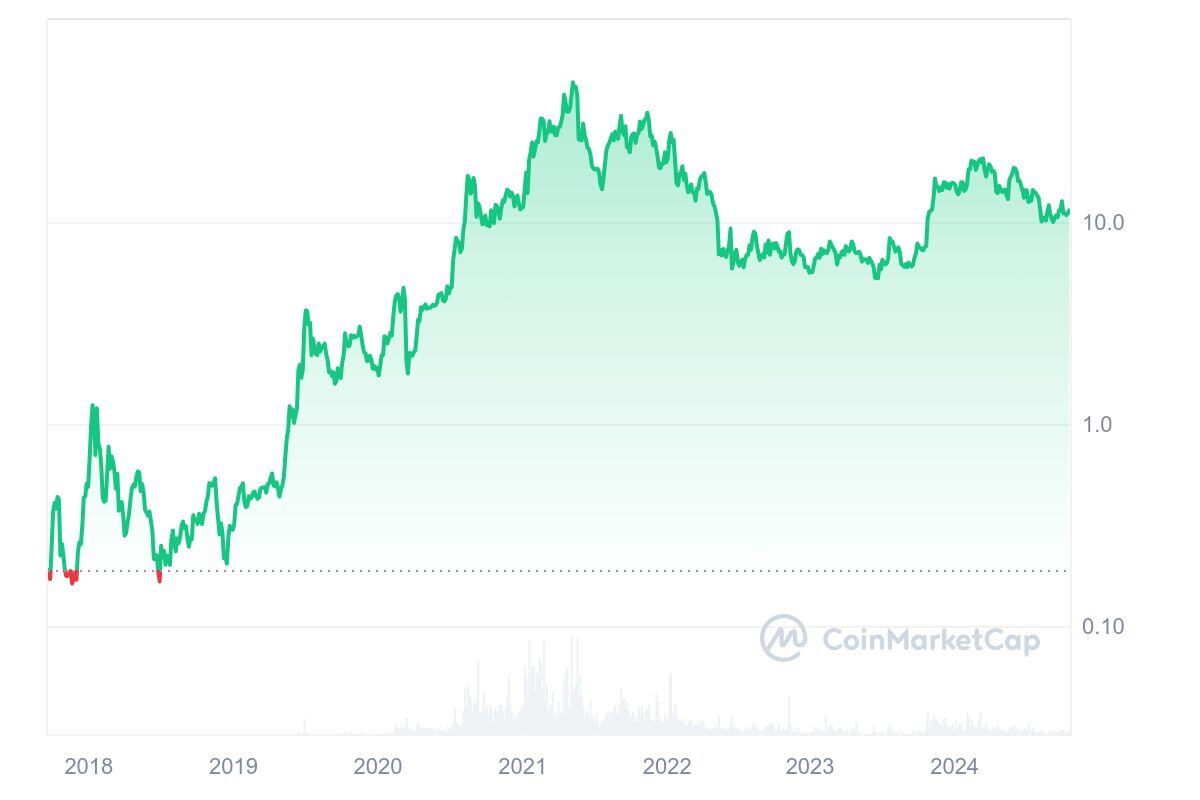

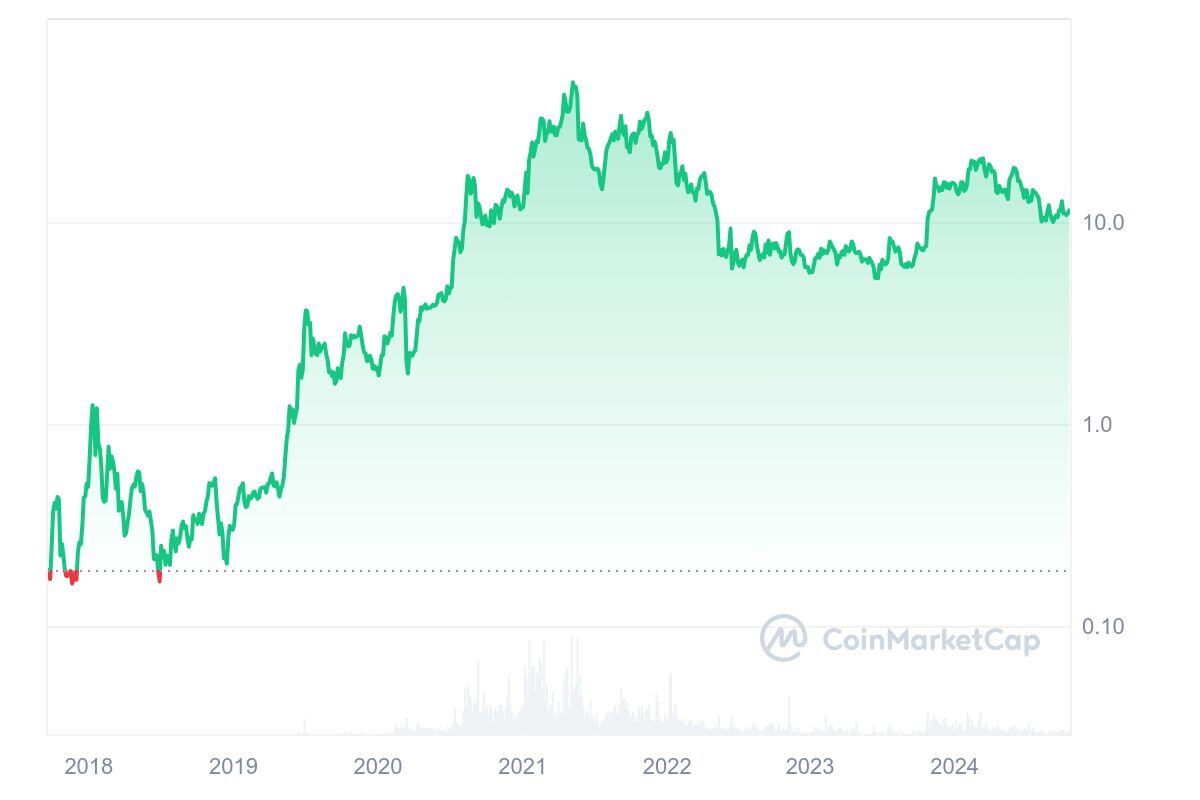

At launch, LINK was trading at around $0.20 and In May 2021, LINK reached a peak value of around $50, driven by the overall growth of the crypto market and the widespread adoption of Chainlink by various DeFi platforms.

Important technology updates, such as the introduction of Chainlink 2.0, and collaborations with leading blockchain projects such as Aave, Synthetix, and Google Cloud have further strengthened LINK's value. Chainlink has a leading position as an oracle provider, but broader volatility in the crypto market and external factors, such as regulatory issues, have impacted its share price.

As seen in the chart below, LINK has entered a consolidation phase after rising to $50, with share prices quoting around $10.

Compared to Bitcoin, LINK is more volatile, as it relies heavily on DeFi adoption and the wider adoption of Oracle solutions within the ecosystem. While Bitcoin is seen as a safe haven, LINK reacts more sensitively to industry-specific trends and innovations. Key factors that continue to influence the value of LINK include market volatility, technological advances, and external factors such as regulation and DeFi trends, which will remain critical to Chainlink's price performance in the coming years.

Advantages of investing in Chainlink

1. Strong ecosystem of partnerships: Collaborations with companies such as Google Cloud and Swift give the project a solid reputation in the crypto world and beyond.

2. Scalability and growth potential: The network continues to grow through the ongoing addition of new features, such as Chainlink VRF and Keepers, contributing to the future usability of the platform.

3. Increasing demand for oracles: As smart contracts continue to grow in popularity, the need for reliable data increases, giving Chainlink an essential position in the ecosystem.

4. Strong community and active developers: Chainlink has an engaged community and a dedicated development team constantly working on improvements and enhancements.

5. Consistent top 20 position in the crypto market: Despite market corrections, Chainlink remains one of the most valuable projects, indicating broad confidence in the platform's future.

.svg)

.webp)